A small, yet symbolic, pricing increase is taking place at�Starbucks (NASDAQ: SBUX ) today.

The premium coffeehouse is rolling out small hikes in select markets. The uptick in java doesn't amount to much. The average increase is a mere 1%, and outside of a $0.10 bump in prices for tall coffees, it's not as if most people will notice that they are paying slightly more for their caffeinated fixes. Our cable bills creep up every year, so why should a cup of Joe be any different?

The rub is that coffee commodity prices have actually gone the other way. Starbucks even pushed through a 10% decrease on its packaged retail coffee products last month! A Starbucks spokeswoman is confirming to Nation's Restaurant News that the small increase is being pushed through today.

Lower coffee costs? Higher consumer-facing prices at Starbucks stores? Shareholders will love this if it's successful. Margins will spike nicely.

Starbucks may be hoping that an influx of new products -- including a new Valencia Orange Refresher, a Shaken Iced Peach Green Tea Lemonade, and Kati Kati blend of East African coffees -- that are being added this morning will blur the increase. Folks will be too dazzled by the new items -- that also includes an orange spiced coffee drink -- to realize that they may be paying slightly more than they used to at some stores for some drinks.

Top Retail Stocks To Buy For 2015: Ulta Salon Cosmetics and Fragrance Inc (ULTA)

Ulta Salon, Cosmetics & Fragrance, Inc. (Ulta), incorporated on January 9, 1990, is a beauty retailer, which provides one-stop shopping for prestige, mass and salon products and salon services in the United States. During the year ended January 28, 2012 (fiscal 2011), the Company opened 61 new stores. It operates full-service salons in all of its stores. Its Ulta store format includes an open and modern salon area with approximately eight to 10 stations. The entire salon area is approximately 950 square feet with a concierge desk, skin treatment room, semi-private shampoo and hair color processing areas. Each salon is a full-service salon offering hair cuts, hair coloring and permanent texture, with salons also providing facials and waxing.

The Company offers products in the categories, such as cosmetics, which includes products for the face, eyes, cheeks, lips and nails; haircare, which includes shampoos, conditioners, styling products, and hair accessories; salon styling tools, which includes hair dryers, curling irons and flat irons; skincare and bath and body, which includes products for the face, hands and body; fragrance for both men and women; private label, consisting of Ulta branded cosmetics, skincare, bath and body products and haircare, and other, including candles, home fragrance products and other miscellaneous health and beauty products. The Company has combined its three operating segments: retail stores, salon services and e-commerce, into one reportable segment.

The Company competes with Macy��, Nordstrom, Sephora, Bath & Body Works, CVS/pharmacy, Walgreens, Target, Wal-Mart, Regis Corp., Sally Beauty and JCPenney salons.

Advisors' Opinion:- [By Sue Chang]

Ulta Salon Cosmetics & Fragrance Inc. (ULTA) �is projected to post fourth-quarter earnings of $1.07 a share.

- [By Chris Hill]

Boeing's (NYSE: BA ) 787 Dreamliner was back in the news (and not for good reasons), which is one reason we prefer Precision Castparts (NYSE: PCP ) . Ulta Salon (NASDAQ: ULTA ) names a new CEO. Tenet Healthcare (NYSE: THC ) makes a big buy. And Facebook (NASDAQ: FB ) is reportedly working on a news service for mobile devices. In this installment of Investor Beat, Andy and Jason discuss four stocks making big moves.

- [By Wallace Witkowski]

Ulta (ULTA) �shares rose 6.9% to $95.70 on moderate volume after the company reported fourth-quarter earnings of $1.09 a share on revenue of $868.1 million.

Top Retail Stocks To Buy For 2015: AutoCanada Inc (ACQ)

AutoCanada Inc. (AutoCanada) is a multi-location automobile dealership groups. As of December 31, 2011, the Company operated 24 franchised dealerships in British Columbia, Alberta, Manitoba, Ontario, New Brunswick and Nova Scotia. During the year ended December 31, 2011, its dealerships sold approximately 28,000 vehicles and processed approximately 300,000 service and collision repair orders in its 333 service bays. As of December 31, 2011, it was authorized to sell through its dealerships the vehicle brands, which include Chrysler, Dodge, Jeep, Ram, Fiat, Hyundai, Nissan, Infiniti, Volkswagen, Mitsubishi and Subaru. In addition, it sells a range of used vehicles. In November 2011, the Company acquired assets of two dealerships. In January 2013, the Company purchased the assets of a Volkswagen dealership known as People's Automotive Ltd. Advisors' Opinion:- [By Greg Quinn]

AutoCanada Inc. (ACQ), the country�� largest publicly traded chain of car dealerships, is using sales of trucks to Alberta oil workers to fund higher dividends and buy out competitors.

Top 10 Telecom Stocks To Invest In 2015: Starbucks Corporation(SBUX)

Starbucks Corporation purchases and roasts whole bean coffees. It operates approximately 16,858 stores, including 8,833 company-operated stores and 8,025 licensed stores. The company offers approximately 30 blends and single-origin premium arabica coffees. It also provides handcrafted beverages, such as fresh-brewed coffee, hot and iced espresso beverages, coffee and non-coffee blended beverages, Vivanno smoothies, and Tazo teas; and merchandise products, including home espresso machines, coffee brewers and grinders, coffee mugs and accessories, packaged goods, music, books, and gift items. In addition, it offers fresh food items, which comprise baked pastries, sandwiches, salads, oatmeal, yogurt parfaits, and fruit cups. Further, it also provides VIA ready brew coffee, bottled frappuccino beverages, discoveries chilled cup coffee, doubleshot espresso drinks, iced coffee, whole bean coffee, and ice creams. The company?s brand portfolio includes Tazo tea, Ethos water, Seatt le?s Best Coffee, and Torrefazione Italia Coffee. Starbucks Corporation sells its products in approximately 50 countries worldwide. Starbucks Corporation was founded in 1971 and is based in Seattle, Washington.

Advisors' Opinion:- [By Russ Krull]

Starbucks (NASDAQ: SBUX ) brewed a grande-size deal with $750 million of 10-year 3.85% notes. The company's press release says the money is going toward "general corporate purposes, which may include business expansion, payment of cash dividends on Starbucks common stock, the repurchase of common stock under the company's ongoing share repurchase program, or financing of possible acquisitions." There are a couple of interesting points in this deal. First, Starbucks only had $550 million in long-term debt, so this deal more than doubles long-term debt. Next, Starbucks has plenty of earnings and cash flow to cover its dividend and a stock repurchase program. The company is expanding, particularly in China, and an acquisition is always a possibility. In short, this looks like a lot of new debt for a company that doesn't really need to borrow.

- [By Tabitha Jean Naylor]

While that cry become a rampant cliché in American pop culture, and fodder for many a late-night talk show monologue, Starbucks (NASDAQ: SBUX) often seems to be on virtually every corner of every street in metropolitan America. While exaggerated, that claim can certainly feels true sometimes -- especially when driving through most major cities.

Top Retail Stocks To Buy For 2015: Aeropostale Inc (ARO)

Aeropostale, Inc., (Aeropostale), incorporated on September 1, 1995, is a mall-based, specialty retailer of casual apparel and accessories, principally targeting 14 to 17 year-old young women and men through its Aeropostale stores and 4 to 12 year-old kids through its P.S. from Aeropostale stores. P.S. from Aeropostale products can be purchased in P.S. from Aeropostale stores, in certain Aeropostale stores, and online at www.ps4u.com. As of January 28, 2012, it operated 986 Aeropostale stores, consisting of 918 stores in 50 states and Puerto Rico, 68 stores in Canada, as well as 71 P.S. from Aeropostale stores in 20 states. The Company designs, sources, markets and sells all of its own merchandise. In addition, pursuant to a licensing agreement, it operated 14 Aeropostale and P.S. from Aeropostale stores in Middle East and South East Asia. During March 2011, it announced that it had signed a second licensing agreement. The licensee to this agreement is focused to open approximately 30 stores in stores in Turkey over the next five years. In November 2012, the Company acquired online women's fashion footwear and apparel retailer GoJane.com (GoJane).

P.S. from Aeropostale offers casual clothing and accessories focusing on kids between the ages of 4 and 12. It�� P.S. from Aeropostale products are sold only at its stores and online through its e-commerce Websites, www.ps4u.com and www.aeropostale.com. The Company operates three street level stores in the New York City area. It also has a19,000 square foot Aeropostale store in the Times Square section of New York City. It offers both Aeropostale and P.S. from Aeropostale products in the Times Square store.

Advisors' Opinion:- [By Ben Levisohn]

Aeropostale�(ARO) has jumped 3.6% to $7.19 after�Bloomberg�reported that the struggling retailer was working out its options with Barclays assistance.

Top Retail Stocks To Buy For 2015: Pier 1 Imports Inc (PIR)

Pier 1 Imports, Inc. (Pier 1 Imports), incorporated in April 30, 1986, is a global importer of imported decorative home furnishings and gifts. As of March 2, 2013, the Company had 1,062 stores in the United States and Canada. During the fiscal year ended March 2, 2013 (fiscal 2013), the Company opened 22 new Pier 1 Imports stores and closed 12 stores. The Company operates regional distribution center facilities in or near Baltimore, Maryland; Columbus, Ohio; Fort Worth, Texas; Ontario, California; Savannah, Georgia, and Tacoma, Washington. The specialty retail operations of the Company consist of retail stores and e-Commerce operations conducting business under the name Pier 1 Imports, which sell a range of furniture, decorative home furnishings, dining and kitchen goods, candles, gifts and other specialty items for the home.

As of March 2, 2013, the Company operated 982 Pier 1 Imports stores in the United States and 80 Pier 1 Imports stores in Canada. During fiscal 2013, the Company supplied merchandise and licensed the Pier 1 Imports name to Grupo Sanborns, which sold Pier 1 Imports merchandise primarily in a store within a store format in 49 Sears Mexico stores and one store in El Salvador. The stores consist of freestanding units located near shopping centers or malls and in-line positions in major shopping centers. Pier 1 Imports operates in all major United States metropolitan areas and many of the primary smaller markets.

Decorative Accessories

This merchandise group constitutes the range of category of merchandise in Pier 1 Imports��sales mix. These items are imported primarily from Asian and European countries, as well as some domestic sources. This merchandise group includes decorative accents, lamps, vases, dried and artificial flowers, baskets, ceramics, dinnerware, bath and fragrance products, candles, seasonal and gift items.

Furniture

This merchandise group consists of furniture and furniture cushions to be used in livin! g, dining, office, kitchen and bedroom areas, sunrooms and on patios. Also included in this group are wall decorations and mirrors. These goods are imported from a variety of countries such as Vietnam, Malaysia, Brazil, Thailand, China, the Philippines, India and Indonesia, and are also obtained from domestic sources. This merchandise group is made of metal or handcrafted natural materials, including rattan, pine, beech, rubberwood and selected hardwoods with either natural, stained, painted or upholstered finishes.

Advisors' Opinion:- [By Roberto Pedone]

My first earnings short-squeeze trade idea is Pier 1 Imports (PIR), a global importer of imported decorative home furnishings and gifts, which is set to release numbers on Thursday before the market opens. Wall Street analysts, on average, expect Pier 1 Imports to report revenue of $404.64 million on earnings of 21 cents per share.

Just recently, Argus said the recent pullback in shares of Pier 1 Imports is providing an attractive entry point, and the firm reiterated its buy rating on the stock with a $27 per share price target. The firm believes that Pier 1 Imports should hold up well in a promotional and competitive environment.

The current short interest as a percentage of the float Pier 1 Imports stands at 5%. That means that out of the 97.51 million shares in the tradable float, 4.90 million shares are sold short by the bears. If the bulls get the earnings news they're looking for, then shares of PIR could jump sharply higher post-earnings as the bears rush to cover some of their bets.

From a technical perspective, PIR is currently trending above both its 50-day and 200-day moving averages, which is bullish. This stock has been uptrending for the last month, with shares moving higher from its low of $20.59 to its intraday high of $23.23 a share. During that uptrend, shares of PIR have been consistently making higher lows and higher highs, which is bullish technical price action. That move has now pushed shares of PIR within range of triggering a near-term breakout trade post-earnings.

If you're bullish on PIR, then I would wait until after its report and look for long-biased trades if this stock manages to break out above some near-term overhead resistance levels at $23.50 to $24 a share with high volume. Look for volume on that move that hits near or above its three-month average action of 1.25 million shares. If that breakout hits, then PIR will set up to re-test or possibly take out its 52-week high at $25.28 a share. Any

- [By DailyFinance Staff]

Stocks took a breather Thursday after racing higher on Wednesday, and the price of gold sank to a three-year low. The major averages ended mixed -- and that's good news, as the market mostly held onto the huge gains that followed the Federal Reserve's taper announcement. The Dow Jones industrial average (^DJI) edged up 11 points, the Standard & Poor's 500 index (^GPSC) slipped a point, and the Nasdaq composite index (^IXIC) fell 12 points. But the price of gold slumped by $39 an ounce, closing below $1,200 for the first time in more than three years. Gold related stocks followed suit. Newmont Mining (NEM), Barrick Gold (ABX) and Goldcorp (GG) all fell about 1.5 percent. Another story getting lots of play today is Target's (TGT) announcement that as many as 40 million credit and debit card customers may have had their account information stolen over the past few weeks. Target shares fell 2 percent. Even though earnings season is still a few weeks away, earnings news was a big factor today. On the upside: Oracle (ORCL), up 6 percent. The software maker beat Wall Street profit and revenue estimates. Food giant ConAgra (CAG), up 5 percent, after topping expectations. And Pier 1 (PIR), also up 5 percent. Net slightly missed, but the retailer raised its dividend by 20 percent.

Top Retail Stocks To Buy For 2015: GUESS? Inc (GES)

Guess?, Inc. (GUESS?) designs, markets, distributes and licenses apparel and accessories for men, women and children. The Company operates in five: Europe, North American Retail, Asia, North American Wholesale and Licensing. The Company�� products are sold through retail, wholesale, e-commerce and licensing distribution channels. The lines include full collections of clothing, including jeans, pants, skirts, dresses, shorts, blouses, shirts, jackets, knitwear and intimate apparel. It also grant licenses to manufactures and distributes a range of products, including eyewear, watches, handbags, footwear, kids' and infants' apparel, leather apparel, swimwear, fragrance, jewelry and other fashion accessories. In fiscal 2012, the Company, along with its distributors and licensees, opened 224 stores in all concepts combined outside of the United Sates and Canada, which consisted of 120 stores in Europe and the Middle East, 89 stores in Asia and 15 stores in the combined area of Central and South America.

As of January 28, 2012, the Company directly operated a total of 504 stores in the United Sates and Canada and 251 stores outside of the United Sates and Canada, and in addition, 230 smaller-sized concessions in Asia and Europe. As of January 28, 2012, its international licensees and distributors operated 804 stores located outside the United Sates and Canada, and 119 smaller-sized licensee operated concessions located in Asia. As of January 28, 2012, it operated retail Websites in the United Sates, Canada, Europe and South Korea. As of January 28, 2012, it had e-commerce available to 26 countries, and in 6 languages around the world. The Company and its network of licensee partners sell its products around the world primarily through six different store concepts, namely its flagship GUESS? retail stores, its GUESS? factory outlet stores, its GUESS by MARCIANO stores, its G by GUESS stores, its GUESS? Accessories stores and its GUESS? Kids stores. The Company also has a small number of footwe! ar, Gc watch and underwear concept stores.

Europe Segment

In the Company�� Europe segment, GUESS? sells its products in 63 countries throughout Europe and the Middle East through wholesale, retail and e-commerce channels. In fiscal 2012, its Europe segment accounted for approximately 37.6% of its revenues. The Company�� European wholesale business generally relies on a large number of smaller regional distributors and agents to distribute its products primarily to smaller independent multi-brand boutiques. The Company�� products are also sold directly to department stores like Galeries Lafayette, Printemps and El Corte Ingles. As of January 28, 2012, GUESS? had showrooms in Barcelona, Dusseldorf, Munich, London, Paris, Florence and Lugano. It sells both its apparel and certain accessories products under the Company�� GUESS? and GUESS by MARCIANO brand concepts through its wholesale channel, operating primarily through two seasons, Spring/Summer and Fall/Winter.

The Company�� European retail network consists of a mix of directly operated and licensee operated GUESS? and GUESS by MARCIANO retail and outlet stores, GUESS? Accessories stores, GUESS? Footwear stores and GUESS? Kids stores. As of January 28, 2012, it had 179 directly operated stores and 382 licensee stores, excluding 17 smaller-sized concessions in Europe. During fiscal 2012, the Company opened 45 new directly operated stores, 75 licensee stores and 5 concessions. The Company�� GUESS? Accessories stores average approximately 800 square feet, GUESS by MARCIANO stores average approximately 1,300 square feet and full-price GUESS? stores generally average 2,300 square feet.

North American Retail Segment

In the Company�� North American Retail segment, it sells its products through a network of directly operated retail and factory outlet stores in North America and through its on-line stores. In fiscal 2012, the Company�� North American Retail segment accounted for ap! proximate! ly 41.6% of its revenue. As of January 28, 2012, it also directly operated 25 GUESS? branded stores in Mexico through a majority-owned joint venture. The Company�� the United Sates and Canada GUESS? retail stores carry an assortment of men's and women's GUESS? merchandise, including most of its licensed product categories. As of January 28, 2012, these stores occupied approximately 1,025,000 square feet and ranged in size from approximately 2,500 to 13,500 square feet, with most stores between 4,000 and 6,000 square feet. In fiscal 2012, it opened nine new retail stores and GUESS? closed four stores.

The Company�� the United Sates and Canada factory outlet stores are located primarily in outlet malls generally operating outside the shopping radius of its wholesale customers and its retail stores. These stores sell selected styles of men's and women's GUESS? apparel and licensed products. As of January 28, 2012, its the United Sates and Canada factory outlet stores occupied approximately 717,000 square feet and ranged in size from approximately 2,000 to 11,000 square feet, with most stores between 4,500 and 6,500 square feet. In fiscal 2012, it opened 10 new factory stores. The Company�� G by GUESS store carries apparel for both men and women and a line of accessories and footwear. As of January 28, 2012, its G by GUESS stores occupied approximately 317,000 square feet and ranged in size from approximately 4,000 to 10,000 square feet, with most stores between 4,000 and 5,500 square feet. In fiscal 2012, the Company opened 12 new G by GUESS stores and it closed three stores.Its GUESS? Accessories store concept sells GUESS? and GUESS by MARCIANO labeled accessory products.

As of January 28, 2012, the Company�� GUESS? Accessories concept stores occupied approximately 122,000 square feet and ranged in size from approximately 1,000 to 4,000 square feet, with most stores between 1,500 and 2,500 square feet. In fiscal 2012, GUESS? opened four new GUESS? Accessories stores and i! t closed ! three stores. The Company�� GUESS by MARCIANO stores in the United Sates and Canada offer a women's collection designed for the stylish, trend-setting woman. As of January 28, 2012, its GUESS by MARCIANO stores occupied approximately 156,000 square feet and ranged in size from approximately 2,000 to 6,500 square feet, with most stores between 2,000 and 3,000 square feet. In fiscal 2012, it opened two new GUESS by MARCIANO stores and the Company closed four stores. The Company�� North American Retail segment also includes its the United Sates and Canada retail Websites, including www.guess.com, www.gbyguess.com, www.guessbymarciano.com, www.guesskids.com, www.guess.ca and www.guessbymarciano.ca. These Websites operates as virtual storefronts that both sell its products and promotes its brands.

Asia Segment

In the Company�� Asia segment, GUESS? sells its products through wholesale, retail and e-commerce channels throughout Asia. In fiscal 2012, its Asia segment accounted for approximately 9.3% of its revenue. Its Asia retail business includes both licensee and the Company operated stores, including GUESS?, G by GUESS, GUESS by MARCIANO, Gc, GUESS? Accessories and GUESS? Underwear stores. During fiscal 2012, it and its partners opened 89 new stores in Asia, as of January 28, 2012, it had 423 stores, 47 of which it operated directly and 376 of which were operated by licensees or distributors. The Company and its partners opened flagship stores in cities, such as Seoul, Shanghai, Hong Kong, Macau, Taipei and Beijing and have partnered with licensees to develop its business in the second tier cities in this region.

North American Wholesale Segment

In the Company�� North American Wholesale segment, it sells its products through wholesale channels in North America and to third party distributors based in Central and South America. In fiscal 2012, its North American Wholesale segment accounted for approximately 7.0% of its revenue. As of January 28, 20! 12, its p! roducts were sold to consumers through 1,005 major doors in the United Sates and Canada. These locations include 345 shop-in-shops, a selling area within a department store that offers an array of its products and incorporates GUESS? signage and fixture designs. The Company has sales representatives in New York, Los Angeles, Toronto, Montreal and Vancouver. During fiscal 2012, Macy's, Inc. was its largest domestic wholesale customer, accounting for approximately 2.7% of its consolidated net revenue.

Licensing Segment

The Company�� licensing segment includes the worldwide licensing operations of the Company. In fiscal 2012, its licensing segment royalties accounted for approximately 4.5% of its revenue. As of January 28, 2012, GUESS? had 19 domestic and international licenses that included eyewear, watches, handbags, footwear, kids' and infants' apparel, leather outerwear, fragrance, jewelry and other fashion accessories; and included licenses for the manufacture of GUESS? branded products in markets, which include Africa, Asia, Australia, Europe, the Middle East, Central America, North America and South America.

Advisors' Opinion:- [By Seth Jayson]

Calling all cash flows

When you are trying to buy the market's best stocks, it's worth checking up on your companies' free cash flow once a quarter or so, to see whether it bears any relationship to the net income in the headlines. That's what we do with this series. Today, we're checking in on Guess (NYSE: GES ) , whose recent revenue and earnings are plotted below.

Top Retail Stocks To Buy For 2015: Radioshack Corporation(RSH)

RadioShack Corporation engages in the retail sale of consumer electronic goods and services through its RadioShack store chain and kiosk operations. Its products include postpaid and prepaid wireless handsets and communication devices, such as scanners and global positioning system (GPS) products; home entertainment, wireless, music, computer, video game, and GPS accessories; media storage, power adapters, digital imaging products, and headphones; home audio and video end-products, personal computing products, residential telephones, and voice over Internet protocol products; digital cameras, digital music players, toys, satellite radios, video gaming hardware, camcorders, and general radios; general and special purpose batteries and battery chargers; and wires and cables, connectivity products, components and tools, and hobby products. The company also provides consumers access to third-party services, such as prepaid wireless airtime and extended service plans in its ser vice platform. In addition, it manufactures various products, including telephones, antennas, wires, and cable products, as well as various hard-to-find parts and accessories for consumer electronics products; and provides repair services. As of March 31, 2011, the company operated 4,467 company-operated retail stores under the RadioShack brand name in the United States; and 1,304 kiosks located in Target and Sam?s Club stores. As of December 31, 2010, it operated 211 company-operated stores under the RadioShack brand, 9 dealers, and 1 distribution center in Mexico; a network of 1,207 RadioShack dealer outlets, including 34 located outside of North America; and 4 distribution centers in the United States. Further, the company sells its products through its Website, radioshack.com. RadioShack Corporation was founded in 1899 and is based in Fort Worth, Texas.

Advisors' Opinion:- [By Philip Springer]

What’s this week’s big story for investors?

Candidate #1: RadioShack (NYSE: RSH) said it will close up to 1,100 of its nearly 5,200 US stores amid widening losses. The company also announced that revenue in the fourth quarter of 2013 fell 20 percent from year-earlier levels.

It doesn’t matter whether the latest announcement is in addition to or merely an expansion of the company’s Feb. 5 statement that it would close 500 stores. That, in turn, shortly followed the beleaguered company’s $4 million expenditure for a widely praised but clearly ill-timed 30-second ad during the Super Bowl.

Also this week, Radio Shack agreed to pay its top executives “retention” bonuses, saying their skills are critical to the company�� comeback plan. CEO Joe Magnacca will get a $500,000 payment, while other executives will receive $187,500 to $275,000.

The stock currently trades around $2, down from its 1999 peak of $61.

No, that’s not the week’s big story. But it was too good to ignore.

Candidate #2: The current bull market celebrates its fifth birthday this week, with the Standard & Poor’s 500 delivering a total return of about 175 percent during that time.

Since 1921, the median bull market has been 50 months long and has delivered 115 percent in price appreciation. So this market is older and better than most. Still, the conditions aren’t yet present to suggest the end is near. Indeed, Wednesday’s advance, the best of the year to date, was exceptional for both its breadth and heavy volume.

The five-year anniversary also means that stocks, mutual funds, exchange-traded funds, closed-end funds and so on will boast very good five-year returns. Don’t be overly impressed. Reason: Almost everybody will be a winner. (Other than Radio Shack.) But you should dig deeper: Comparisons will be useful to sort out leaders and laggards for potential investme - [By Paul Ausick]

There were a several analyst upgrades and downgrades�today, including:

RadioShack Corp. (NYSE: RSH) has been dropped from coverage by Oppenheimer; Intel Corp. (NASDAQ: INTC) raised to ��eutral��at Piper Jaffray; Apache Corp. (NYSE: APA) cut to ��old��at Stifel Nicolaus; Kaiser Aluminum Corp. (NASDAQ: KALU) raised to ��uy��with a price target of $80 at Sterne Agee; and Dollar General Corp. (NYSE: DG) raised to ��verweight��at J.P. Morgan.The only earnings reports of note since last Friday came from Saks Inc. (NYSE: SKS) which is trading down 0.2% at $15.99.

- [By GuruFocus]

Dr. Paul Price wrote an article called Wake-Up Calls Often Come Too Late. He discussed the collapses of the stock prices with Green Mountain Coffee (GMCR), Netflix (NFLX) and Soda Steam (SODA). As pointed correctly out by Adib Motiwala, value investors are rarely hurt by companies like Green Mountain Coffee, Netflix and Soda Steam. The reason is simple. These stocks are usually traded at extremely high valuation and value investors would normally avoid the situations like these. Value investors are much more likely hurt by the stocks like Nokia (NOK), RadioShack (RSH) and Research-in-Motion (RIMM) as these stocks have been traded for very low valuations. Value investors thought that they were buying into value, while they were actually buying into value traps. The valuation just gets lower, and lower.

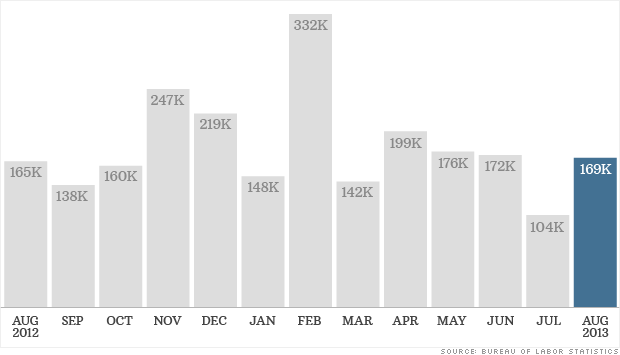

WASHINGTON (CNNMoney) Hiring continued at a slow pace in August, and the unemployment rate fell as more Americans dropped out of the labor force.

WASHINGTON (CNNMoney) Hiring continued at a slow pace in August, and the unemployment rate fell as more Americans dropped out of the labor force.  Thomas Piketty on his book 'Capital' NEW YORK (CNNMoney) This is how they argue in economics: over spreadsheets.

Thomas Piketty on his book 'Capital' NEW YORK (CNNMoney) This is how they argue in economics: over spreadsheets.

Bloomberg

Bloomberg

What AT&T gets by buying DirecTV

What AT&T gets by buying DirecTV