Procter & Gamble (PG) is generally regarded as one of the best consumer staple stocks that's currently available for purchase. P&G is a U.S.-based company that produces a large portfolio of consumer goods like cleaners, health products, and pet foods. Behind A.G. Lafley, its CEO, P&G raked in over $80 billion in revenues in 2012. It's commonly regarded as an incredibly safe investment vehicle and has been a favorite of many fund success stories, including that of Warren Buffett.

If P&G isn't a widely known name, the products that it makes almost certainly are. P&G is responsible for such brands as Bounty, Charmin, Crest, Dawn, Downy, Duracell, Febreze, Gillette, Iams, Pampers, Pantene, Tide and Vicks - how many of these do you have floating around your house right now? Did you know that many of the items you consistently use and buy on a daily basis are P&G products?

The Buffett school of common sense states that these are exactly the types of companies that make attractive investments. I commented on this in My 17 Definitive Cardnial Rules for Investing Success, where I stressed applying common sense to your positions.

Why not invest your assets in the companies you really like? As Mae West said, 'Too much of a good thing can be wonderful'.

- Warren Buffett

If you consider yourself a sensible, logical person who prides yourself on common sense skills, this is a great segue to get P&G into your portfolio in some facet. Invest in the things you see everyday, have to purchase and like purchasing, that will be around for a while. The products you buy and use every day contribute to the well being of the company that you're invested in - and this is generally my argument for contending that P&G is now, and will be in the future, a great vehicle for your money.

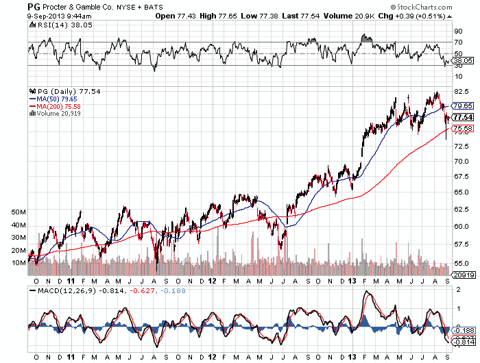

In the midst of our bull market that we've been in, P&G has continued to provide solid returns, yielding investors about 13% in the last 12 months.

P&G's three-year ch! art is a testament to how the stock has performed throughout its history, not just over the past three years:

(click to enlarge)

P&G is an attractive investment for a couple of reasons. The company is extremely focused on advertising, which is an extremely integral part of the consumer goods business. The things that people buy on a weekly or bi-weekly basis - like toothpaste, beauty supplies, garbage bags, etc - are important staples for general household living. Because something like shampoo, as a product, is never not going to be a necessity, it's a constant ongoing battle between consumer goods companies to make sure that their products are the ones that are being pulled off the shelf every week, as opposed to those of competitors.

Best Value Companies For 2014

P&G has advertising down to an art form, effectively doing it through focus groups and studies, and spending hundreds of million on advertising every year. The company takes a similar attitude to research and development, investing significantly in R&D every year with a focus on continuing to innovate products.

P&G has a strong footprint all over the world, but there are currently opportunities for expansion, most notably in China. In early 2012, ChinaDaily reported that P&G was starting to build new property in China:

Procter & Gamble has begun construction of one of the largest manufacturing sites in Asia, aiming to serve the fast-growing China market.

The new Luogang Plant is in Guangzhou, where P&G's China headquarters is located, and will be built in three stages. The first stage, set to begin operations in the second half of 2013, will produce a variety of goods including baby care products, such as Pampers diapers.

The company did not reveal the co! st of the! new plant, but said it is part of a $1 billion investment in China to be implemented by 2015.

"The Luogang Plant will produce multi-category products that complement the Huangpu Plant and expand P&G's scale of production in the region," said Shannan Stevenson, P&G's president for Greater China. "The new plant once again demonstrates P&G's confidence in the China market and its commitment to Chinese consumers."

In addition, the management is tasteful about how it spends money - recently implementing a 5-year cost saving program that could save up to $10 billion. The Wall Street Journal reported:

Procter & Gamble Co. PG +0.59% plans to eliminate more than 4,000 jobs and streamline its massive marketing budget, in an effort to pare back a relatively bloated cost structure that has weighed on the consumer-products giant's profits.

The cuts, which follow 1,600 job losses already planned for the current fiscal year, are aimed at saving $10 billion by 2016. They represent a rare extensive pruning for the company. P&G has long spent heavily to hire, retain and train managers to run its huge portfolio of brands, leaving it with a higher cost base than many rivals.

"If you think about it, the company is [nearly]175 years old, and it's only the second time it's done this," said Ed Tazzia, global chairman of the P&G Alumni Network and a principal with management consulting firm Sycamore and Co., based in Bloomfield Hills, Mich. "In a world where resizing and reorganization is a daily thing, I think comparatively-because it's so rare-it says a little bit about Procter. They take it pretty seriously."Investors have long been frustrated by P&G's inability to operate more efficiently, and the company's stock rose 3% on the news Thursday. The cuts are also aimed at addressing a mismatch between where P&G spends much of its money-developed countries like the U.S.-and the emerging markets in which the company is seeing m! ost of it! s sales growth.

Not letting your fundamentals get out of line is something that I'm a big supporter of. Cost cutting is something that's recently made Bank of America (BAC) a bullish call for me as well. It's important, no matter how big your company is, to have a firm grasp on every dollar that leaves the company bank account. Fundamentals are always number one, and P&G showing it's aware of that continues to make it an attractive investment.

As the icing on the cake, P&G has paid handsome dividends for over a hundred years, raising them consistently as well. The company is sitting on an enormous pile of cash and, due to its safety is well worth the sizable P/E that it trades at (20.12) - as P&G will continue to outlast recessions and prove to be a rock for yet another several decades. As always, best of luck to all investors.

Source: Why Procter & Gamble Is A Rock Solid InvestmentDisclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

No comments:

Post a Comment